In 2023, Fruit Stripe, which was launched 54 years ago was known for its fruit-inspired flavors and zebra-print product was discontinued. The gum came in five flavors: Wet n’ Wild Melon, Cherry, Lemon, Orange and Peach. Each pack came with a temporary tattoo of its mascot, Yipes the Zebra. They considered many factors before coming to this decision, including consumer preferences, and purchasing patterns – and overall brand trends for Fruit Stripe Gum.

CNN+

In 2022, CNN pulled the plug on the network’s $100 million venture into online streaming only 3 weeks after launching CNN Plus.

CNN Plus was the cable-news giant’s bet on digital streaming and its hedge against the rising popularity of the “cord cutting” that has led to a steady erosion of cable subscriptions. It sought to lure viewers with exclusive, original programs hosted by familiar CNN journalists and newcomers such as former Fox News host Chris Wallace and actress Eva Longoria that could be watched live or on-demand. It also offered documentaries and special series already aired by CNN, including the popular food-and-travel programs hosted by Stanley Tucci and the late Anthony Bourdain.

But CNN Plus was unable to offer its subscribers streaming access to CNN’s popular daily television news programs because of noncompete restrictions in its contracts with cable distributors. And in its first month, it appeared to be having trouble persuading enough customers to sign on to the $5.99 monthly service.

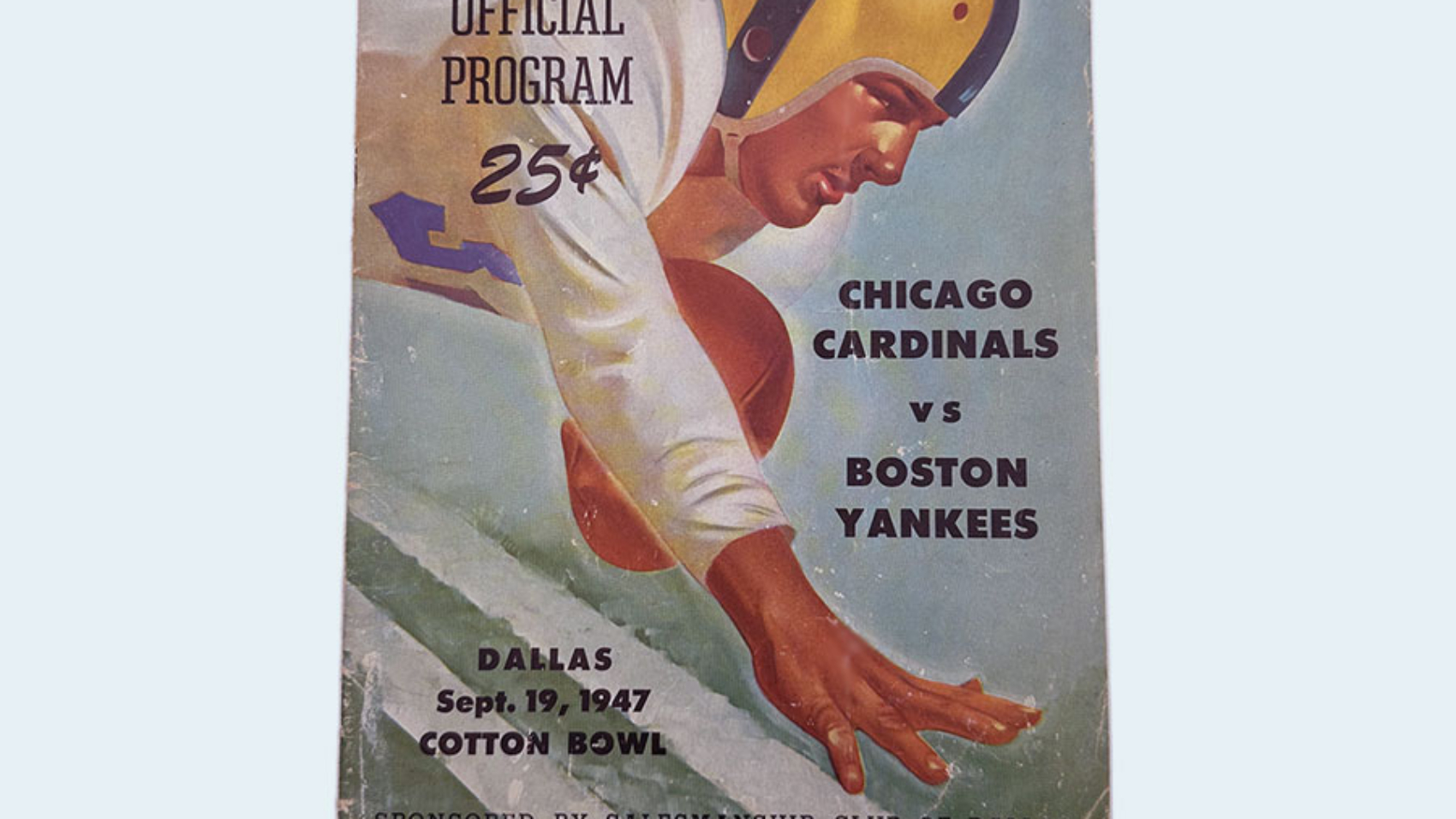

Boston Yankees

The Boston Yankees were an NFL team who played from 1944-1948. The team played its home games at Fenway Park. Team owner Ted Collins picked the name Yankees because he originally wanted to run a team that played at New York City’s old Yankee Stadium.

After three continuous losing seasons, Collins finally was allowed to move to New York City. But instead of an official relocation, he asked the league to officially fold his Boston franchise and give him a new franchise, for a Federal tax write-off.

The Boston Yankees are the only officially defunct NFL team ever to have the first overall NFL draft pick. They had it twice, in 1944 and 1946.

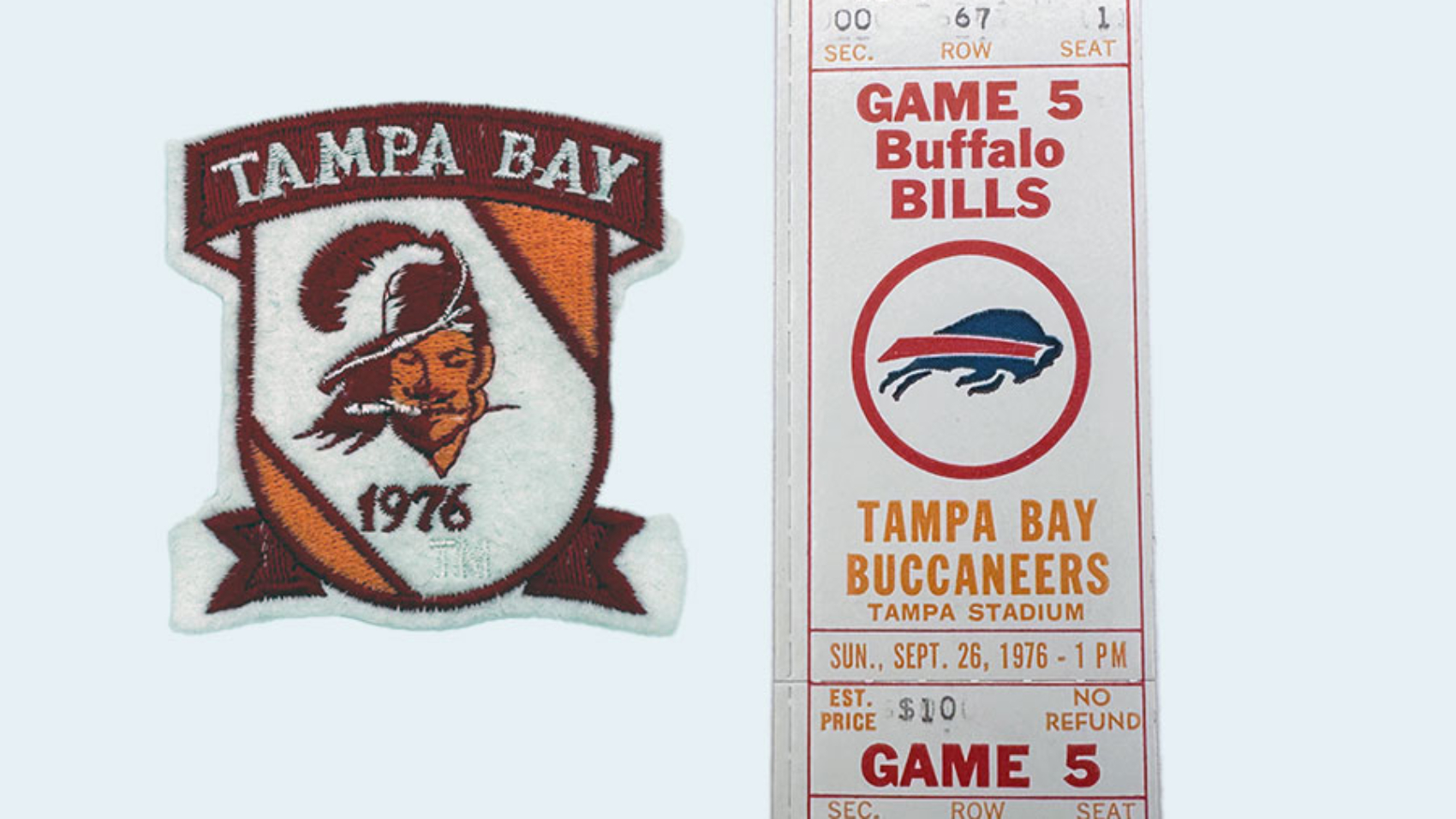

Tampa Bay Buccaneers 1976

In 1976, the Tampa Bay Buccaneers were the NFL’s first winless team once the season expanded to 14+ games with an 0-14 record. Detroit was 0-16 in 2008, while the Cleveland Browns were 0-16 in 2017.

This was the Buccaneers’ first season; they did not score until their third game and did not score a touchdown until their fourth. They lost by more than a touchdown eleven times. They were last in the league in points scored, touchdowns, and rushing touchdowns.

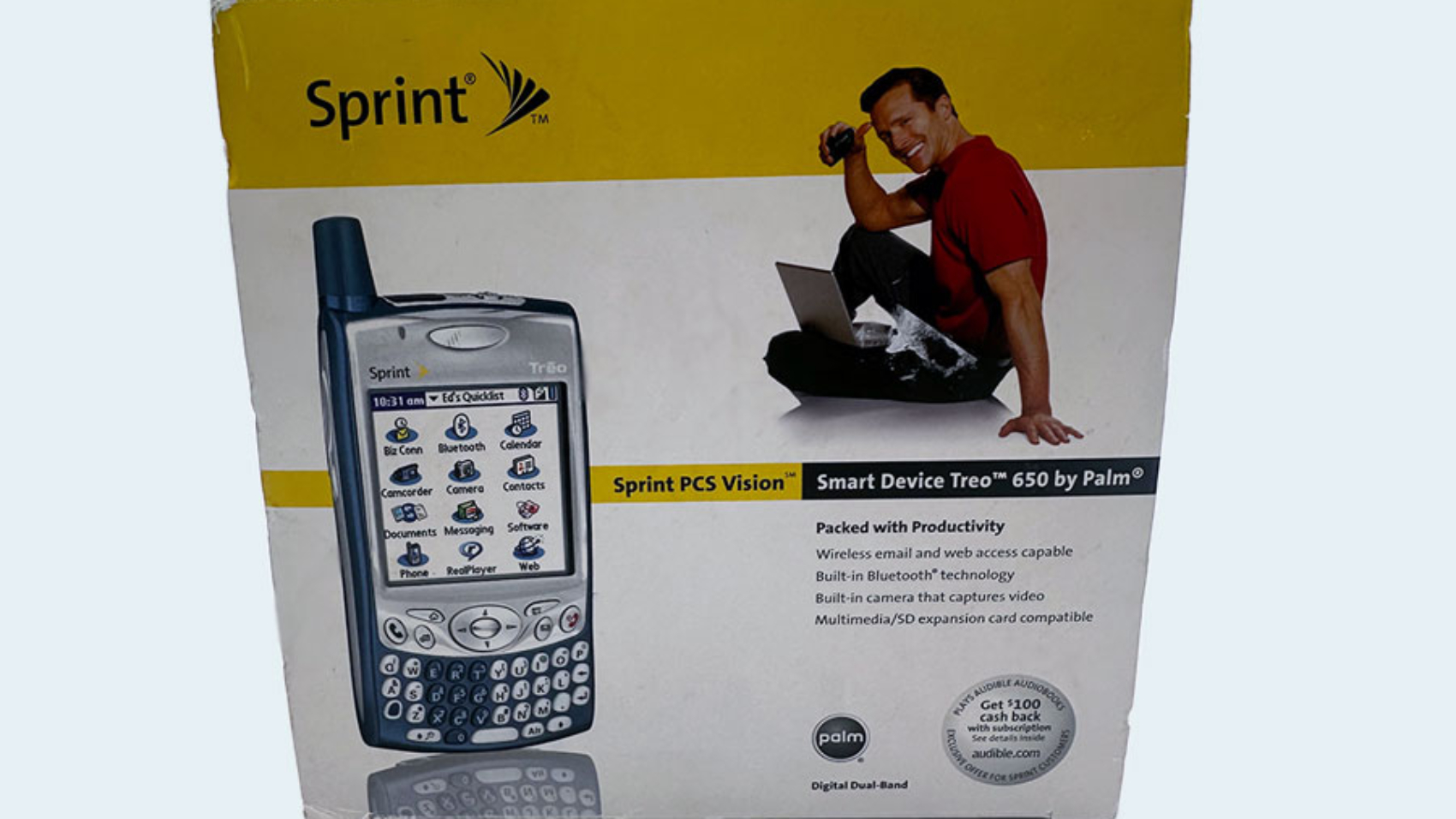

Palm Treo

Palm Treo was developed by Handspring, which Palm acquired in the early 2000s. Palm, one of the earliest makers of smartphones, was unable to follow up its success in the personal organizer business. The company was slow to realize that consumers wanted wireless voice and data from the same device. Palm couldn’t find the formula for over-the-air synchronization with Microsoft Outlook, which business users demand and RIM nailed with its BlackBerry device. Palm also suffered from multiple product delays.

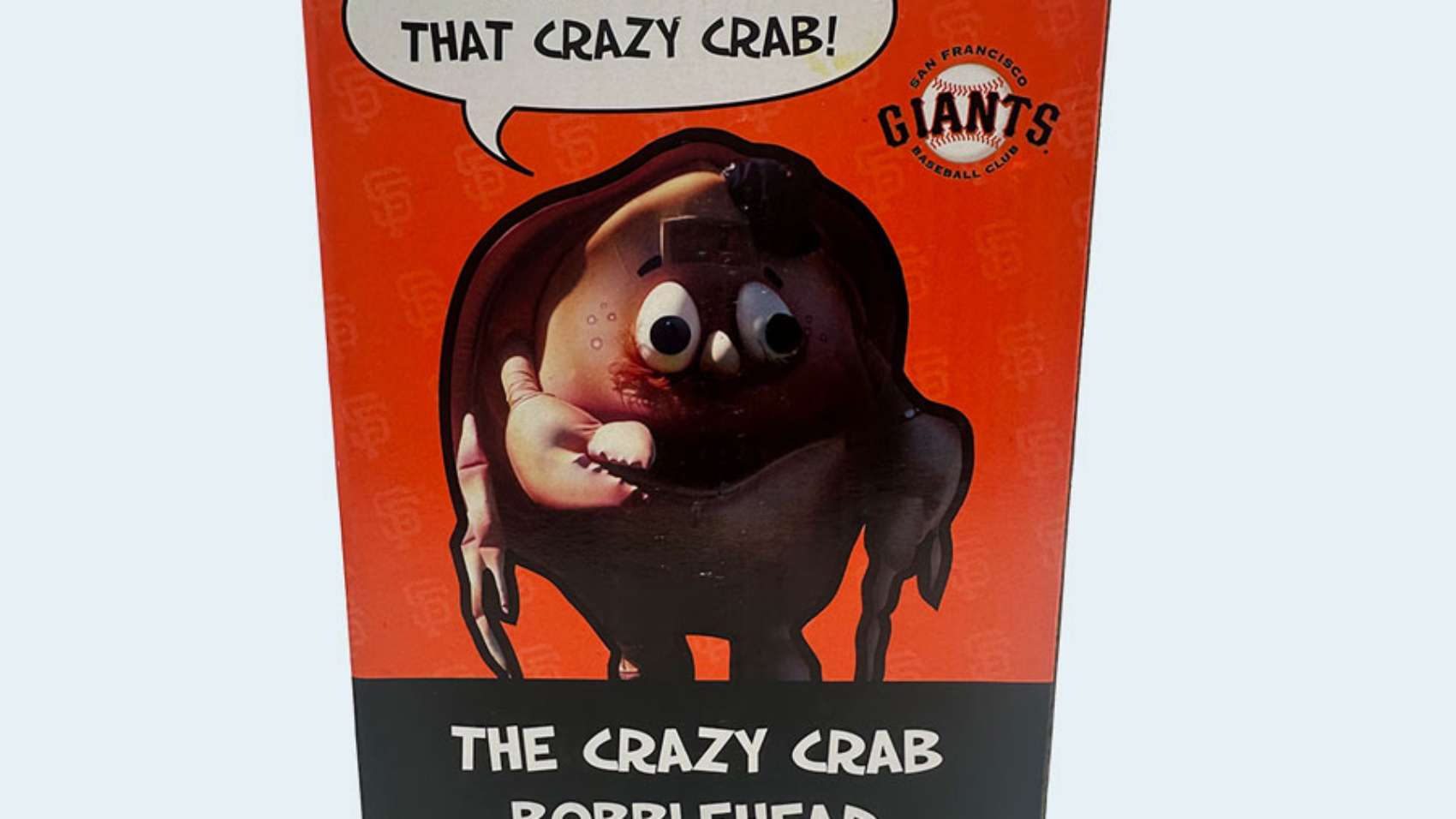

Crazy Crab mascot of the SF Giants

With fans not having much reason to show up to Candlestick Park in 1984, the Giants and its copywriters introduced the Crazy Crab, a proto-Gritty crustacean designed to be hated. The season’s tagline was “Hang in There” was they were the worst team in baseball with a 66-96 record. In 1996, the Giants introduced their current mascot, Lou Seal, while they added a Crazy Crab sandwich station when Oracle Park opened in 2000.

OpenView Venture Partners

9 months after OpenView raised its largest fund ($570M) in March 2023, they abruptly laid off staff and stopped making new investments after two of its 3 leaders left the firm.

Kelly-Moore Paints

In 2024, after 78 years in business, Kelly-Moore Paints shut down and closed its 157 stores nationwide.

For over 30 years, the company had been grappling with thousands of asbestos litigation claims related to the company’s past use of asbestos in cement and texture products under prior ownership, a practice that was discontinued in 1981. Through the cumulative cash drain caused by legal settlements and the cost of defending ever-continuing case filings, the company’s ability to reinvest in the business – including investments needed to address historical supply chain challenges that were exacerbated by the pandemic – had been severely constrained for an extended period of time. Despite paying out approximately $600 million over the past 20 years to settle asbestos claims, a study commissioned by the company estimated future asbestos liabilities exceed $170 million.

Largely due to the asbestos litigation overhang, it was impossible to attract any additional funding or interest to recapitalize, restructure or reorganize the business. Ultimately, the company’s leadership team determined with the assistance of outside advisors that the company was financially unable to continue operations.

Sports Authority Field

Sports Authority signed a 25 year, $6 million per year naming rights deal with the Denver Broncos in 2011. The deal was forfeited when Sports Authority shut down in 2016. The current stadium name is Empower Field at Mile High.

Sports Authority was a very over-leveraged company, and it had $1 billion in debt coming due over the next two years. Meanwhile, competition from omnichannel merchants, as well as brands themselves, made it difficult for Sports Authority to stand out in the marketplace. Big box stores such as Wal-Mart and Target, as well as Dick’s and brands such as Nike (which has its own stores), pushed Sports Authority towards irrelevancy.

Beyond.com

Beyond.com, a career network that connects job seekers with employers through career channels, was a casualty in the dot com bust.